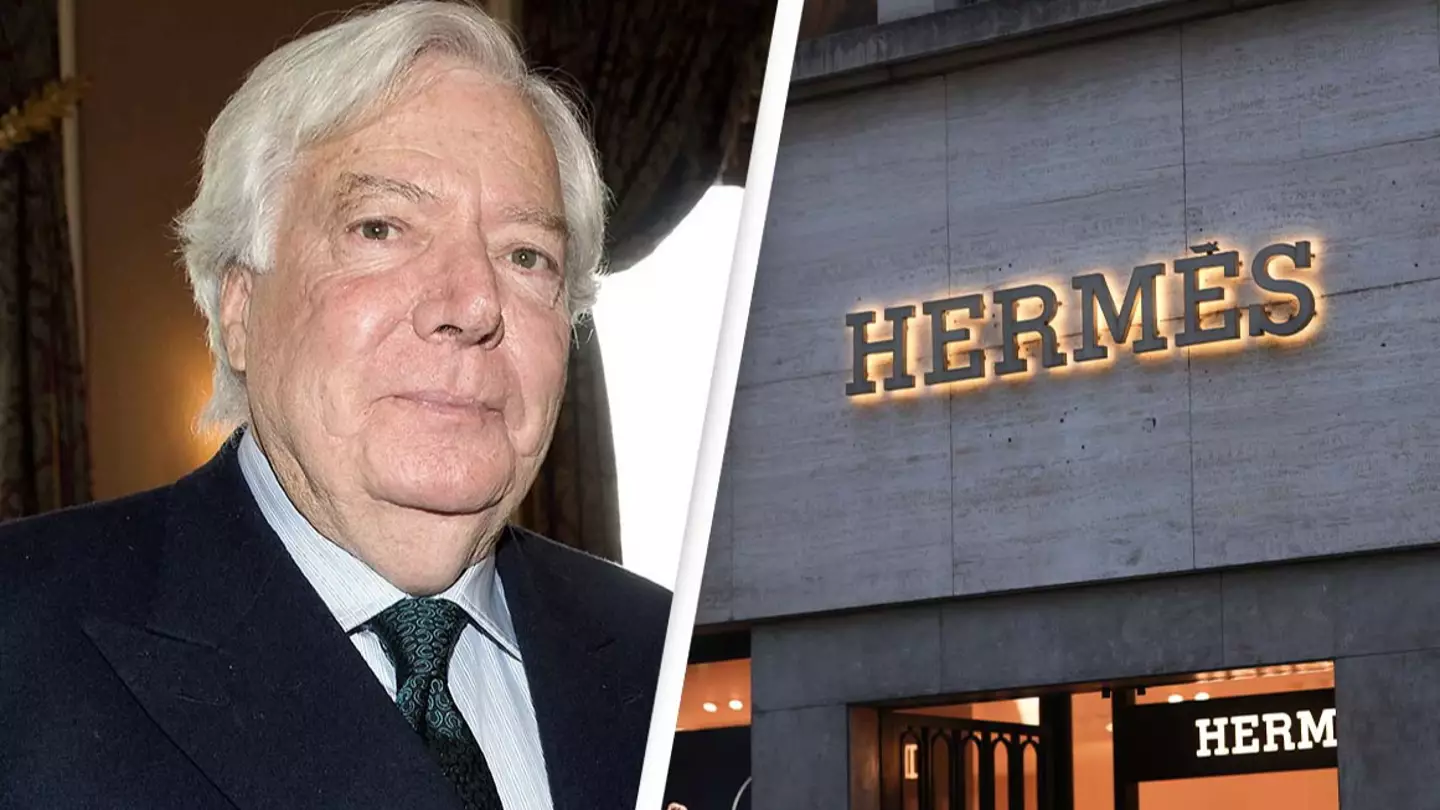

It looks like one of Hermès heir Nicolas Puech’s grand inheritance plans might be missing a crucial element—the actual funds. Despite his ambitious intentions, the financial backing isn’t quite there. Last year, the 81-year-old billionaire caused a stir by promising to leave half his fortune to his former gardener after he passes away. But now, things have taken a turn. A Swiss court has dismissed Puech’s allegations that his financial advisor mishandled his Hermès shares, which are worth about INR 1.08 lakh crore ($13 billion), leaving him empty-handed, according to Bloomberg.

Puech’s lawyers stated that the heir once held around 6 million shares, making him the largest investor in Hermès International SCA’s history—though he no longer owns them.

The Hermès family, one of the wealthiest clans in Europe, has a combined net worth of around INR 12.98 lakh crore ($155 billion). Their story began in 1837 with the founding of the French luxury design house that has since become renowned for its Kelly and Birkin handbags.

The eighth-generation heir has accused his financial manager, Eric Freymond of committing fraud over the two decades when all his shares were sold.

The court has sided against Puech’s claims, pointing out that he had placed “blind trust” in Freymond and could have ended their agreement at any point. Gradually turning into a case that illustrates how a lack of oversight can lead to unexpected complications, the ruling also noted that Puech had willingly allowed Freymond to manage his finances, including granting access to his bank accounts.

Puech ended his agreements with Freymond in October 2022, and just a year later, he launched three separate lawsuits against his former wealth manager, as reported by Bloomberg. The initial lawsuit claimed that Freymond had kept critical information from Puech and refused to return his Hermès shares. The other two lawsuits focused on Freymond’s handling of Puech’s charity, loans and other investments.

Starting in 1998, Puech began moving his Hermès shares to Swiss banks, eventually amassing a total of 6 million shares. From then on, he handed over a series of signed mandates to Freymond, entrusting him with the management of his accounts. By 2001, the shares were being brought, sold and transferred through one of these banks. He handed over the keys to a high-stakes investment car and watched as it was driven through a maze of transactions over the years.

During a nearly two-year period ending in October 2010, a substantial profit of INR 485.14 crore (€53.7 million) was made from share sales. That same month, Arnault disclosed to the Hermès family that he had acquired a stake in the company. Despite this, Puech had no objections to Arnault’s involvement and even viewed him as an “ally”, according to Robb Report. However, Puech’s family orchestrated a clever strategy that managed to keep Arnault at a distance, turning what could have been a collaborative opportunity into a tense standoff.

Puech found himself at odds with his relatives over his alleged involvement in how rival LVMH CEO Bernard Arnault had acquired a stake in Hermès. The disagreements escalated to the point where he decided to step down from the Hermès supervisory board in 2014, taking his roughly 5.7% stake with him.

Since the ruling wrapped up on July 12, the fate of Puech’s missing stocks remains a mystery. Meanwhile, one can’t help but imagine that a certain gardener is keeping a hopeful eye out, waiting to see if those elusive shares will eventually surface.

Discover more stories on luxury, business, culture, and innovation here at Candle Magazine